Does the UK have a savings problem or a risk problem?

“As safe as houses?” Does the UK have a savings problem — or a risk problem?

The current debate around the Cash ISA has surfaced a deeper issue in the UK:

how we think about risk, wealth and what constitutes investment for the future.

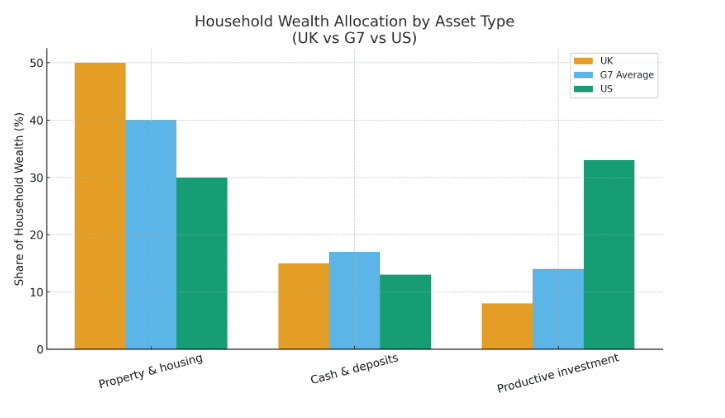

When we benchmark the UK’s household wealth allocation across the G7, the picture is clear:

We are an outlier.

The UK has one of the highest concentrations of household wealth tied up in property and cash, and one of the lowest levels in productive investment — the kind that creates growth, funds innovation, supports businesses, and builds stronger communities.

(For accuracy: we sit mid-pack on cash — close to Germany and nowhere near Japan — but we are still overly reliant on property and passive saving.)

For decades, media, policy and cultural norms have reinforced one narrative:

property = safety.

Financial advisers everywhere sigh at the familiar phrase: “My property is my pension.”

But this belief has consequences:

- It locks capital into unproductive assets, rather than circulating into companies and local projects that need it.

- It drives inequality, pricing out younger generations and concentrating wealth in fewer hands.

- It cements a culture where risk is something to avoid, not something to understand and manage.

The result?

We don’t have a savings problem. We have a risk problem.

We are a nation taught to fear investing altogether.

Crowdfunding and community investment already demonstrate that people will invest — when they understand what they’re investing in, why it matters and who benefits.

And this isn’t just about wealth creation.

It’s also about how wealth flows through society. There is plenty of debate about using tax to redistribute wealth — yet almost none about how the financial system itself is designed to benefit those who already hold assets (and want to preserve them) versus those with few assets and limited access to credit. The system conserves wealth; it does not circulate it.

If we want a more resilient, more equal and more innovative UK economy, we need to shift the conversation:

- From short-term downsides to the long-term balance of risk and reward

- From “as safe as houses” to “as productive as businesses and communities.”

- From passive saving to active investing in our places, our companies and our future.

The question isn’t whether people have enough money to invest.

The question is: do we have the right system — and the right education — to help people invest confidently?